Cannabis Banking – Focus on the Risk

Risk and compliance professionals within financial institutions know that customer due diligence is the foundation of any well designed Know Your Customer program. Customer due diligence policies, processes, and procedures are designed specifically to provide transparency and help the institution understand its customers and those customers’ intended activity and lower its risk profile. High risk customers require a risk-based approach supported by enhanced due diligence. Unfortunately, this means that you will add cost and friction to your cannabis customer segment. Robust enhanced due diligence processes are important for high-risk customers, and commercial cannabis businesses are no different, but financial institutions do not need to overthink the level and complexity. Focus on obtaining answers that establish the risk profile based on the risks you are likely exposed to, for example: money laundering and inversion/diversion to the illicit cannabis market.

Cannabis Banking Due Diligence

Banking commercial cannabis businesses is no riskier than banking other regulated, higher-risk customer types. You need to understand who you’re serving, so your due diligence requirements for this customer base can be both efficient and effective. It is common for financial institutions to request licenses and information on beneficial ownership, and it is also best practice to complete site visits where you can compare the commercial cannabis business’s standard operating procedures (SOPs) to what you’re actually seeing on premise. Other measures that you can take include background checks and negative news searches on the business, as well as on the high-level executives and decision makers.

ACCCE offers a complimentary webinar on cannabis banking due diligence that covers these topics and much more. Check it out here: Cannabis Banking Due Diligence – Deep Dive (US) – ACCCE

Risks by Cannabis Sector

That said, there is no one size fits all approach to banking commercial cannabis businesses. It is not enough to simply ask your customers if they are growers, for example. It would serve you better to implement enhanced due diligence by sector.

ACCCE and NatureTrak produced this complimentary handout on cannabis banking risks by sector.

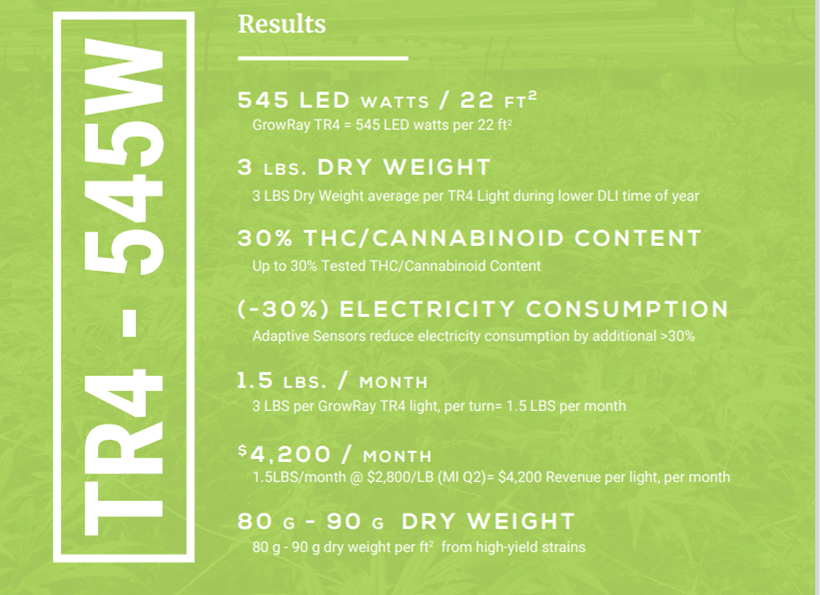

Reasonable Yield

A large factor of the risk profile for cannabis banking is establishing the inherent risk for money laundering and the illicit cannabis market specific to each client. As part of your cannabis banking due diligence, you would establish metrics that help you measure this inherent risk. For example, a cannabis banking program that includes indoor grows should be able to calculate a reasonable harvest weight range. Establishing a harvest weight range allows you to establish the harvest value range. The harvest weight and value range allow you to reasonably predict the customer’s transaction pattern and their inherent risk to money laundering and illicit cannabis market.

One way to establish a harvest weight range is to identify formal third-party information that would allow you to identify indirect metrics to establish the harvest weight range. A standard metric for weight in an indoor grow is dry weight by lbs/light or g/ft2. Many light providers identify these metrics in their case studies and the information can be useful as an independent source for your benchmark numbers. This can reduce the complexity of the due diligence because the number of lights and canopy space is normally documented and easily verifiable in a site visit. This harvest metric can then be compared to the track and trace information to identify unusual activity.

Image used with permission from GrowRay.com

GrowRay has published indoor figures here.

GrowRay has published greenhouse figures here.

The Association of Certified Commercial Cannabis Experts (ACCCE) is dedicated to advancing the professional knowledge and skills of those committed to commercial cannabis risk management.

Click here more information on how ACCCE can help our members at commercial cannabis financial institutions.