The Association of Certified Commercial Cannabis Experts

Create Your Competitive Advantage in Cannabis Banking with a Risk-Based Approach

Financial institutions need to document proof that they can manage the risk of banking commercial cannabis customers.

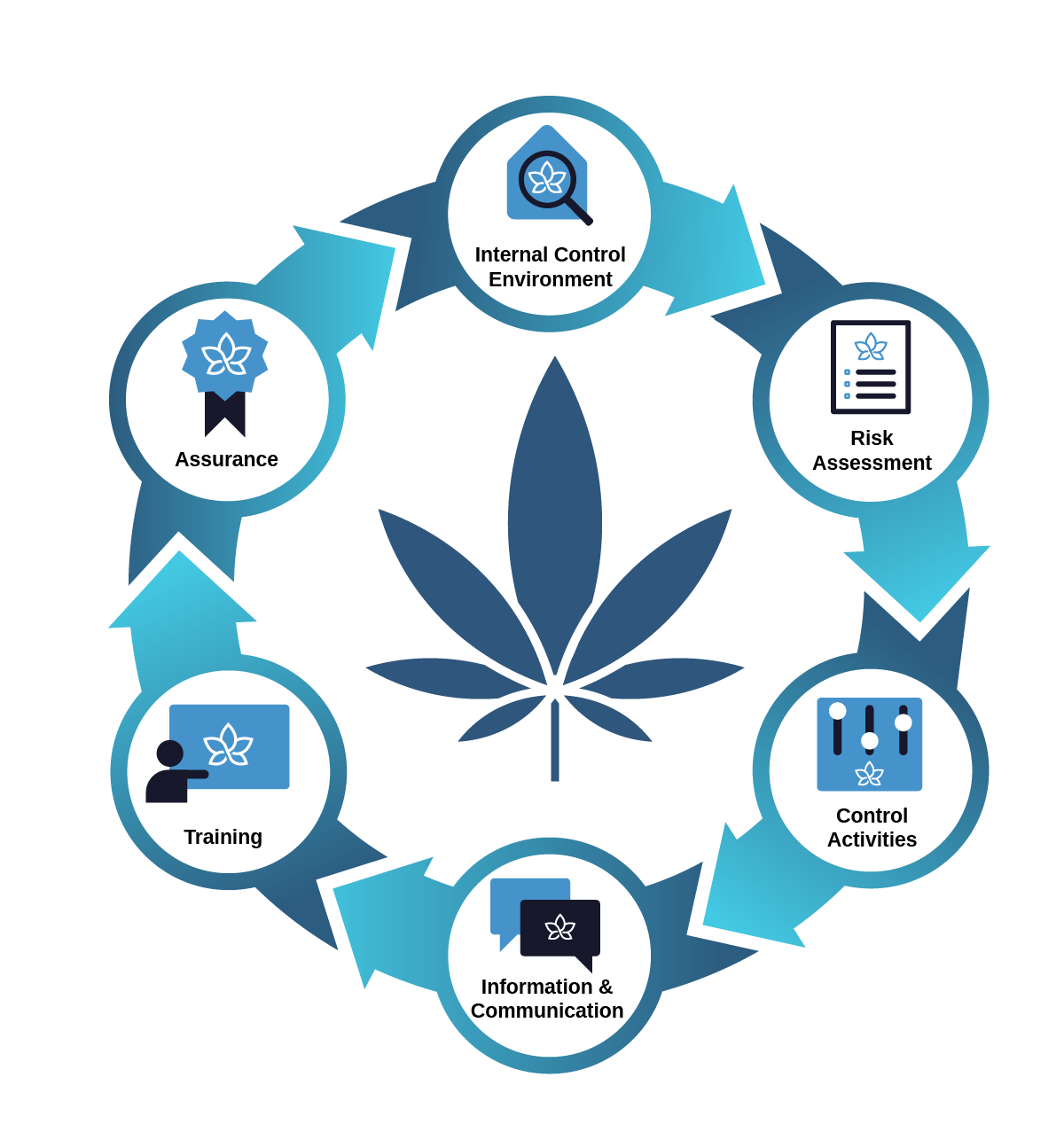

Reduce onboarding and ongoing due diligence friction through the application of ACCCE’s Cannabis Risk Management Framework (CRMF). The CRMF provides a risk-based strategy that allows the bank to determine if the customer has implemented an effective well-designed risk-based compliance program

Join ACCCE today to learn about risk management best practices that help your financial institution save time and money.

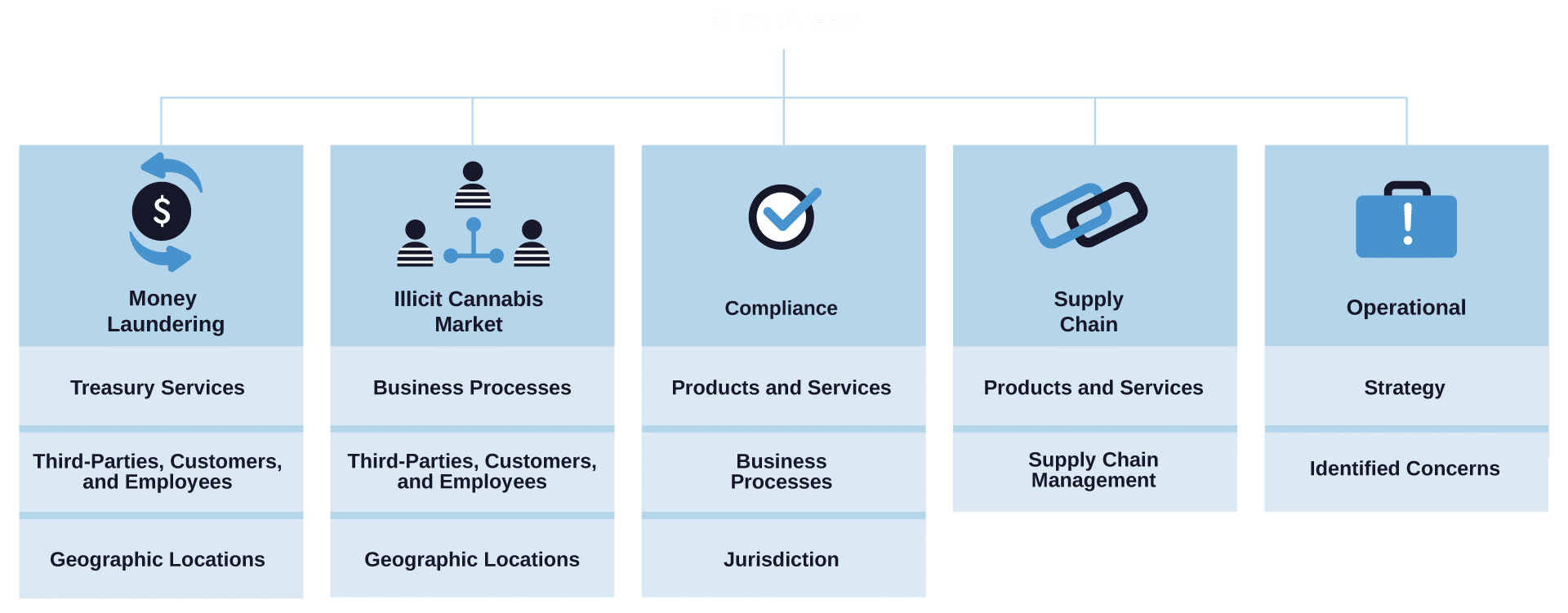

Common Risk Areas and Drivers for Commercial Cannabis Businesses

Our risk assessment format identifies risk from Money Laundering, Illicit Cannabis Market, Compliance, Supply Chain, and Operational risk areas affecting commercial cannabis businesses.

Design your cannabis banking program guided by ACCCE’s CRMF to collect proof that your commercial cannabis customers have implemented a well-designed risk program that appropriately allocates resources and focus on their highest risk issues. Covering all of these areas shows the customer’s intent to comply.

Tactical Resources

Comprehensive Cannabis Banking Program

Job Aid

Cannabis Banking Due Diligence Concerns

Job Aid

Lead Cannabis Director Checklist

Job Aid

Resource Library

Resources and tools are developed specifically for cannabis banking onboarding and ongoing AML requirements. Our resources consider financial institution regulations, are risk based, and can be tailored to the financial institution’s needs.

Tailored Education

Cannabis banking requires specialized education for the financial institution to demonstrate current knowledge of commercial cannabis industry risks. Tailored training allows you to determine if you should move forward with cannabis banking or expand by analyzing and maturing controls to match the fast pace and higher risk needs of the commercial cannabis industry. ACCCE offers a range of specific cannabis banking training and workshop topics.

Webinars & Community Events

Engaging webinars and community events keep risk professionals abreast of current and emerging trends across the commercial cannabis industry and specific to cannabis banking. These events highlight risk issues, case studies, and details about the commercial cannabis industry that affect the financial institution’s risk profile.

Provide ACCCE’s Customizable Templates to Help Your Cannabis Customers Manage Risk

Our Risk Program Template and Compliance Risk Assessment Template can be downloaded and evaluated against what your financial institution currently has in place and can be provided to your commercial cannabis customers.

These templates will save you time and money because:

- They are ready to be tailored to meet your commercial cannabis customer’s needs

- Instructional documents are included to help guide your commercial cannabis customers in completing the templates

Webinars

Webinars and live events provide forums to discuss emerging issues and best practices in international commercial cannabis risk management. ACCCE provides evidence of continuing education for those that attend our webinars, community events, tailored training, etc.

Cannabis Banking Due Diligence:

Deep Dive

Proper due diligence on a commercial cannabis business allows a financial institution to reasonably predict expected transactions, identify unusual activity, and understand the ownership and control of the commercial cannabis business.

Cannabis Banking in the Boardroom:

Risk Management

Cover key data to benchmark your cannabis banking program with best practices for cannabis banking board oversight and resources to bring back to your own boardroom.