Executive and director roles for compliance and risk management are consistently found in highly regulated industries such as pharmaceutical, financial services, alcohol, tobacco, and publicly traded companies. As the commercial cannabis industry matures, similar roles are forming, but the roles are at different levels of maturity between commercial cannabis businesses and other highly regulated industries, and that is OK. Understanding why varying degrees of maturity in risk management are acceptable between industries is helpful.

Sarah

Tim Rademaker, CCCE

Tim is the CEO of Trellis, a financial services company that provides commercial cannabis operators access to banking through, Unify Financial Credit Union. Our membership with ACCCE provides the tools and resources we need to demonstrate our commercial cannabis operators’ lower risk profile.

Dede Perkins, CCCE

Dede joined the cannabis industry in 2013 as a member of the application team that won one of the first competitive vertically integrated applications in Massachusetts. After that, she helped win cannabis licenses in New York, Maryland, Pennsylvania, Ohio, California, Arkansas, North Dakota, and Nevada. A regulatory specialist, Dede is passionate about combining compliance with operational excellence; safe, standardized products; empowered employees; strong company culture and brands.

Jacob Morehead, CCCE

Jacob is an Australian native with 10 years of working anti-money laundering and counter-terrorism financing experience within the APAC region, however, he now resides in the United States. He has a bachelor’s in Business majoring in Finance and is a Certified Commercial Cannabis Expert (CCCE). Jacob has specialized in risk management, working with highly regulated industries such as Banks, Gaming, FinTechs with NBFI/MSB/Gaming licenses, and marijuana businesses. Jacob has vast experience in regulatory compliance and AML/CTF in the US, Australia, New Zealand, Japan, Malaysia, Hong Kong, and the EU. The commercial cannabis market is exciting! The market is continuing to mature in key regions such as North America where it is legalized, but at the same time, is still in its infancy within the APAC region, and specifically in Australia where it remains illegal.

William J. Cousins, CPP, CCCE

ACCCE offers me the opportunity to work with cohorts who are involved in the cannabis industry. Working with these professionals allows me to share my knowledge of how to design and implement Crisis Management Plans for cannabis businesses. It also affords me the ability to gain further knowledge of risk management best practices. Being a part of ACCE allows me to not only reach out and share my knowledge, but I am also able to expand my knowledge by working with the other members. In my opinion, ACCCE is the leading organization for risk management professionals who work in the cannabis industry. – William J. Cousins, CPP, CCCE, Chief Executive Officer of WJ Cousins & Associates LLC

Garrett Gafke, CCCE

Garrett is the President at Intellicheck, an age verification technology serving the cannabis industry. Over the past decade, his focus has been on identity, an area integral to the success of the cannabis industry. He joined ACCCE because he sees ACCCE as the highest bar of professionalism throughout the Cannabis industry, becoming a CCCE is another step in his commitment to risk management and compliance, and better equips him to serve the industry.

Form 8300 – Do You Have Another IRS Issue?

In the United States of America, commercial cannabis businesses must be aware of the Internal Revenue Service (IRS) requirements for Form 8300 when receiving over $10,000 in cash for a single or related transaction. To reduce your civil and criminal risk exposure, start your risk-based approach to Form 8300 compliance today with a risk assessment, system of control, and looking at the past.

Nahid Rahman

Nahid is an AML/CTF consultant at Toronto Compliance and AML Events (TCAE) where he extends his knowledge of regulatory expectations and related Acts to help organize bi-weekly webinars on regulatory compliance topics, to create content to disseminate complex concepts in bite-sized knowledge nuggets, to coordinate training programs and to foster collaboration among internal teams across various projects. To say the least, TCAE is fortunate to have Nahid as a part of its team.

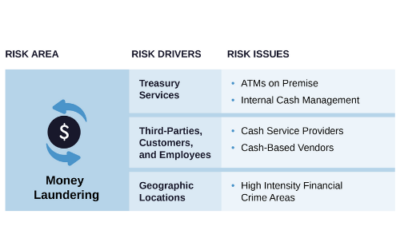

On-Site ATMs: Know Your Money Laundering Risks

If your commercial cannabis business has an ATM on-site, you need to know about the money laundering risks that you are exposed to. This article describes the ATM risk issue, red flags to be aware of, and controls that you can put in place to mitigate the risk.

Philip DS Martin

Philip is a former commercial cannabis regulator and Bank Secrecy Act (BSA) compliance officer for financial institutions and FinTech’s who is currently serving as the Chief Compliance Officer and Director – Professional Services for NatureTrak, Inc. NatureTrak is an enterprise software firm that provides an automated system of BSA internal controls designed to provide full lifecycle compliance and risk management tools to financial institutions that want to safely serve cannabis businesses while maintaining a sound and effective BSA program. His work focuses on increasing the availability of financial services for commercial cannabis businesses by developing a software solution that reduces a financial institution’s risk, while streamlining banking activities for the commercial cannabis business. Philip earned a bachelor’s degree in political science from Richmond, the American International University in London, has been a Certified Anti Money-Laundering Specialist (CAMS) since 2016, and a Certified Commercial Cannabis Expert (CCCE) since 2020.