Valuation is Risk Dependent

One of the best days in the life of an entrepreneur is finding a major investor. Commercial cannabis business or not, the investment process flow is similar. Connect with a potential investor, provide a macro financial and business overview of the company for the investor to provide a letter of intent, the investor conducts due diligence to identify the business valuation, price is negotiated, and the deal is completed. Unfortunately, this day can take a sudden turn for the worst if the entrepreneur is unaware of how the due diligence process affects valuation of the business.

Most businesses are, or should be, prepared to show their evaluation of the competitive landscape, financial projections, business growth plans, management strength, and identified business, regulatory, and legal risks. However, in highly regulated industries like cannabis, it is important to demonstrate your ability to manage the identified risks as they change over time. Take two investment options that are similar in every way except risk management: an investor would choose the company that can distinctly demonstrate their ability to manage their risks into the future. An investor values risk management because it increases confidence in realizing the future revenue stream.

Building your business to the point where investors are interested is hard. Establish your risk culture today or you may leave significant value on the table or lose the opportunity to a similar competitor with a stronger risk culture. Establishing basic risk management practices has a significant impact on business valuation.

First Steps to Being Prepared

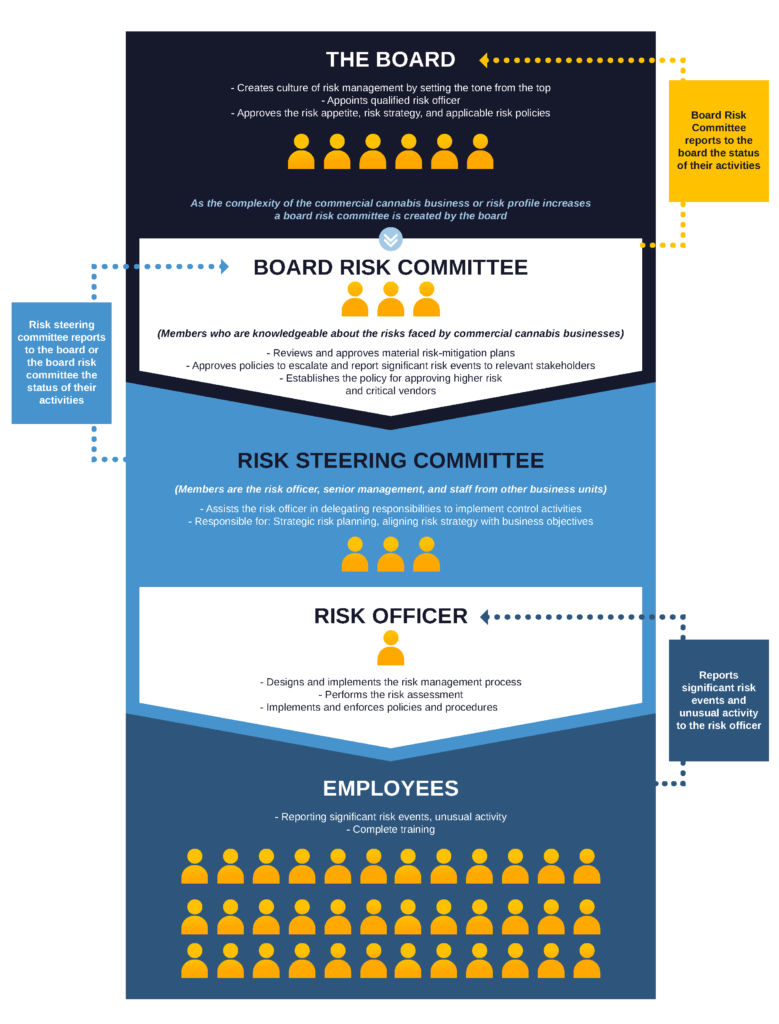

Establishing a strong risk culture is mainly about governance. From an investment standpoint, knowing the risks that a business is exposed to is helpful, but seeing a management team capable of managing those risks is valuable. One of the strongest elements in a risk culture is having risk management assigned to a qualified employee with the proper authority to execute a risk program.

A qualified employee has appropriate training, industry experience, and managerial background for the complexities faced by the commercial cannabis business. Risk management training should be specific to the risks that your business will be exposed to so that risk mitigation can be specific and effective. The qualified employee should understand the structure of the cannabis industry and the specific role their commercial cannabis business has in the licensed cannabis product supply chain. Finally, having appropriate managerial background to interact with other senior management and the board of directors is imperative to establish and maintain the tone at the top for risk culture.

These steps are normally formalized in a risk program approved by the board of directors. If you don’t have a risk program, ACCCE offers a customizable risk program template to help you get started.

Proper authority means that the assigned employee should have the appropriate resources, communication path to senior management and the board, and authority to execute the day-to-day tasks of the risk program. To demonstrate commitment to your risk culture, the risk program should be funded adequately to accomplish the goals identified by the commercial cannabis business. Every employee is responsible for managing risk, which can only be accomplished if they understand their role in risk management. To shape the risk culture, the qualified employee must have appropriate authority to assist all managers in executing their risk responsibilities. Setting the roles and responsibilities for risk management is normally formalized in the risk program. For a visual representation of roles and responsibilities, refer to ACCCE’s Roles and Responsibilities infographic.

Conclusion

These actions can materially change your business valuation. A risk program with tone from the top empowers all stakeholders to make informed risk-based decisions that move the business forward safely. Having a history of managing risks through a formal risk program that focuses resources on the highest risk issues provides reassurance to investors that their investment will remain safe.

An investor given two investment options that are similar in every way except the strength, commitment, and risk management focus, an investor would choose the company that can better demonstrate their ability to manage their risks into the future. The company with stronger risk management is more likely to deploy capital efficiently and deliver its future revenue stream. Investors place a premium on strong risk management because they are unlikely to be the only interested party. This is in line with the ESG concept that most investors subscribe to.

More value is given to risk cultures that have formal documentation and practices built over time. These elements give outside parties the confidence that they are buying the great business you have presented them. Without demonstrable proof, it is hard to value the risk management work that your company engages in.

While you could build your risk culture from scratch, it can save you time and money if you work within an industry framework. Commercial cannabis businesses gain more value when they invest their time tailoring their risk program to their company’s specific risks rather than developing every foundational aspect from scratch. Standing on the shoulder of giants allows you to build with a better view of what to expect.

The Association of Certified Commercial Cannabis Experts (ACCCE) is dedicated to advancing the professional knowledge and skills of those committed to commercial cannabis risk management.

Click here for more information on how ACCCE can help our members in the commercial cannabis industry.