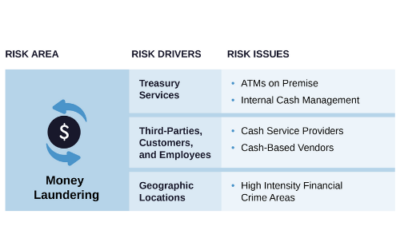

If your commercial cannabis business has an ATM on-site, you need to know about the money laundering risks that you are exposed to. This article describes the ATM risk issue, red flags to be aware of, and controls that you can put in place to mitigate the risk.

Cannabis Risk Management Framework

Compliance & Risk Management: Two Functions, One Strategy

Compliance and risk management are two distinct functions that should be unified by one risk management strategy. A risk-based approach is a common risk management strategy in highly-regulated industries that optimally facilitates compliance while also mitigating other risks. A properly implemented risk-based approach creates a broader level of protection for the business, employees, and investors from reputational, administrative, civil, and criminal penalties.

3 Key Lessons From the First Cannabis Banking Enforcement Action

In what appears to be the first penalty levied against a financial institution banking commercial cannabis businesses, Live Life Federal Credit Union has entered into an administrative order with the National Credit Union Administration (NCUA) for failures related to its cannabis banking program. As Live Life Federal Credit Union emerges from this administrative order, and more lessons are learned, cannabis bankers will be more empowered to make the appropriate risk-based decisions when it comes to managing their MRB portfolios.

Risk Management Makes Your Business More Valuable

In highly regulated industries like cannabis, it is important to demonstrate your ability to manage the identified risks as they change over time. Take two investment options that are similar in every way except risk management: an investor would choose the company that can distinctly demonstrate their ability to manage their risks into the future. An investor values risk management because it increases confidence in realizing the future revenue stream.

Purposefully Achieve Your Company’s Goals with a Compliance Risk Assessment

Risk and compliance professionals know that operating a highly regulated business is difficult. But in the cannabis industry it is exceedingly difficult because of jurisdictional variances and rapidly changing regulations.

K.I.S.S. Your Risk Profile

Implementing a risk profile does not have to be overly complicated. Risk professionals who know how to communicate their company’s risk profile in a clear, concise manner can best help their senior managers and board of directors make the best risk-based decisions to move their business forward safely.

Make Risk-Based Decisions Part of Your Culture and Stop Firefighting

For commercial cannabis businesses to succeed, risk management should be incorporated into every employee’s job. This helps every cannabis operator reduce public harm, increase public safety, and maintain a sound licensed cannabis market that is profitable to operate in. Risk management isn’t built in a day, but the sooner you start, the sooner everyone gets to do their job.

3 Steps for a Robust Risk Assessment Process

Maintaining compliance in the commercial cannabis industry can be daunting, considering how highly regulated the industry is and how quickly rules change. A compliance risk assessment will help your commercial cannabis business focus resources on the regulatory risks that matter most to your business.

Integrating Harvest Yields For Cannabis Banking

Cannabis banking requires a benchmark for cannabis operators growing cannabis so that the yield from a grow can be monitored for reasonableness. This allows cannabis bankers to reasonably predict transaction patterns to determine the risk of money laundering and inversion/diversion to the illicit cannabis market.

Creating a Culture of Compliance: An Open Secret

Building a strong culture of compliance is essential to most businesses, but especially important to cannabis operators managing a rapidly changing regulatory landscape with increasing regulatory expectations.