From the ground up, Sean is intimately familiar with cannabis operations, having operated and managed all facets of a vertically integrated, multi-state, cannabis food and topical manufacturing company. During his time within the industry, he has overseen the product life cycle of 26 unique cannabis-infused food and cosmetic products from concept to commercialization. His responsibilities have included facility design and construction, product research and development, process design and validation, standard operating procedures, and most importantly creating and executing quality control and safety programs.

Brion Nazzaro

Risk Officers Support the Board

How does a Risk Officer help company Directors understand the risks to the business? The role of the risk officer is a trusted advisor to keep the board informed of risks so the directors can make reasonably informed decisions. Risk officers provide information to the board on many topics, including information needed to execute their duties as outlined in their job description, challenge management assumptions, advise management on strategy, build value, ensure leadership, and understand regulatory complexities of corporate transactions.

How can I interview a compliance or risk officer and figure out if they are the right candidate?

How can I interview a compliance or risk officer and figure out if they are the right candidate?

Ask these 3 questions: How will you protect our business? How will you enable others to do their jobs? How will I know if you will implement a risk strategy that works for my business?

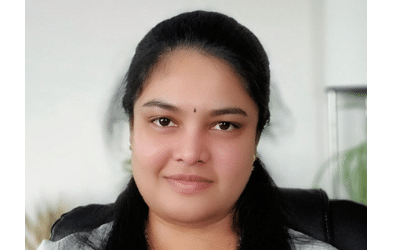

Anuraga Mandava

Anuraga is the Chief Consultant for Qualium Consulting. Qualium Consulting provides compliance support to the craft operators in the Canadian cannabis industry. She has a bachelor’s degree in Food Science and Technology from ANGRAU, India, and a master’s degree in Food Process Engineering from Illinois Institute of Technology, Chicago. Anuraga’s first job was in endurance food and supplement manufacturing company, but after slowly transitioning into health products and pharmaceuticals, she’s found her career in the cannabis industry.

Why Should a Company Implement a Risk-Based Approach

In highly regulated industries, most companies reduce the risk of civil and criminal exposure by taking a risk-based approach that shows the company’s intent to comply.

Compliance & Risk Management: Two Functions, One Strategy

Compliance and risk management are two distinct functions that should be unified by one risk management strategy. A risk-based approach is a common risk management strategy in highly-regulated industries that optimally facilitates compliance while also mitigating other risks. A properly implemented risk-based approach creates a broader level of protection for the business, employees, and investors from reputational, administrative, civil, and criminal penalties.

Make Risk-Based Decisions Part of Your Culture and Stop Firefighting

For commercial cannabis businesses to succeed, risk management should be incorporated into every employee’s job. This helps every cannabis operator reduce public harm, increase public safety, and maintain a sound licensed cannabis market that is profitable to operate in. Risk management isn’t built in a day, but the sooner you start, the sooner everyone gets to do their job.

Integrating Harvest Yields For Cannabis Banking

Cannabis banking requires a benchmark for cannabis operators growing cannabis so that the yield from a grow can be monitored for reasonableness. This allows cannabis bankers to reasonably predict transaction patterns to determine the risk of money laundering and inversion/diversion to the illicit cannabis market.

Creating a Culture of Compliance: An Open Secret

Building a strong culture of compliance is essential to most businesses, but especially important to cannabis operators managing a rapidly changing regulatory landscape with increasing regulatory expectations.

A Game of Cat and Mouse: Looping for Diversion

As the commercial cannabis industry becomes more entwined in the economy, it is of utmost importance to defend the business against bad actors.