Commercial Cannabis Insights

Executive and director roles for compliance and risk management are consistently found in highly regulated industries such as pharmaceutical, financial services, alcohol, tobacco, and publicly traded companies. As the commercial cannabis industry matures, similar roles are forming, but the roles are at different levels of maturity between commercial cannabis businesses and other highly regulated industries, and that is OK. Understanding why varying degrees of maturity in risk management are acceptable between industries is helpful.

When an inspector finds a deficiency or violation, how do they decide the appropriate level of punishment? While there is no standard across all states, many agencies take intent into account. Regulators evaluate the company's compliance program—if there is one—and determine if it's an active program or merely a paper program designed to assuage external stakeholders.

A retail dispensary self-reported non-compliant activity and the original fine of $62,500 was reduced to $45,000. Self-reporting is a positive step in addressing non-compliance and sends a positive tone from the top message to all stakeholders. Let’s examine the event and learn from it.

Supply chain management risk comes to the forefront in a recent cannabis flower recall. It is reported that contaminated single-use gloves were responsible for a recall of cannabis flower products from a pesticide-free cannabis producer and processor in South Lake Tahoe, California. The antimicrobial chemical o-Phenylphenol was identified as the contaminant found in the FDA-compliant food-grade gloves that the grower used. Kirk Berry breaks down how a risk-based approach can be used to analyze the issue.

After measuring the size of the grows, the LCB determined they were out of compliance by 50%. Based on their determination, the LCB destroyed thirteen thousand pounds of harvested flower that the three growers had produced. Thirteen thousand pounds is a lot to lose so let us dive into this event, discuss risk management and compliance, and how you might approach these issues to avoid being out of compliance.

On November 5, 2021, the cannabis compliance board from the state of Nevada issued a public health and safety bulletin for product recalls. The recall included 14 different edible products from one supplier that were distributed to 10 different dispensaries. Kirk provides a succinct analysis and 6 things to consider to make sure you are ready for a recall.

Why do I want my compliance and risk officer(s) to achieve a risk management certification?

A certified compliance officer is better equipped to effectively develop a comprehensive plan to achieve your business objectives. They are trained to spot high-risk activity prior to non-compliance or misconduct. They are better able to understand how to enable all employees to make informed risk-based decisions.

The EVALI cases in 2019 were certainly a common topic of discussion. After reading this report I would like to highlight a few of the reports interesting conclusions: 1) in states where marijuana policies were in effect, a statistically lower number of EVALI cases were seen, 2) EVALI incidents were about 40% lower in states that allow recreational marijuana use, 3) contaminants found in marijuana vaping products were problematic.

Operators must not only manage the day-to-day challenges unique to the industry, but they must also find ways to improve performance while reducing costs if they wish to remain competitive. While profitability and market share are the ultimate goal, maintaining compliance in an ever-changing regulatory environment puts additional pressure on companies looking to carve out their piece of the pie. Unfortunately, the pursuit of profits and the desire for a competitive advantage can sometimes lead to hasty decisions that result in unnecessary operational risk. The good news is that with the proper planning, processes, and systems in place, managers and executives can significantly reduce the operational risk associated with their business.

How does a Risk Officer help company Directors understand the risks to the business? The role of the risk officer is a trusted advisor to keep the board informed of risks so the directors can make reasonably informed decisions. Risk officers provide information to the board on many topics, including information needed to execute their duties as outlined in their job description, challenge management assumptions, advise management on strategy, build value, ensure leadership, and understand regulatory complexities of corporate transactions.

Like most things in life, you can think of risk management and compliance on a spectrum. We have three basic areas of the spectrum. In the middle, we find most operators who want to avoid deficiency notices, fines, and enforcement. They’re interested in managing risk and compliance, but may not have spent the time or resources to master the process. For all of you who are looking to develop and implement a compliance program or seek to improve the program you already have, this article is for you.

How can I interview a compliance or risk officer and figure out if they are the right candidate?

Ask these 3 questions: How will you protect our business? How will you enable others to do their jobs? How will I know if you will implement a risk strategy that works for my business?

The Cannabis Act has explicit rules for the packaging and labeling of cannabis products to ensure that they do not take on an appearance of something that might be enticing or appealing to young persons. The rules are comparable in the U.S., even if they vary slightly by state law.

One situation where both jurisdictions can learn from each other's mistakes occurred in 2020. A raffle held at a Canadian youth hockey tournament contained a prize consisting of several cannabis products. The winner was an eight-year-old boy who was participating in the tournament.

Commercial cannabis businesses tend to focus on preserving compliance with regulations in order to satisfy licensing requirements; however, managing risk holistically involves more than looking at the regulations.

Read this real-world case study of a commercial cannabis enforcement action and learn how to protect your business from potential penalties.

In highly regulated industries, most companies reduce the risk of civil and criminal exposure by taking a risk-based approach that shows the company’s intent to comply.

In the United States of America, commercial cannabis businesses must be aware of the Internal Revenue Service (IRS) requirements for Form 8300 when receiving over $10,000 in cash for a single or related transaction. To reduce your civil and criminal risk exposure, start your risk-based approach to Form 8300 compliance today with a risk assessment, system of control, and looking at the past.

Compliance enforcement actions have long been used by regulators to push a licensee to comply and when severe enough, can be detrimental to the future success of a business. Commercial cannabis businesses may suffer disruptions in supply chain, loss of reputation and revenue among other things. A formalized risk program denotes a commitment to compliance and is strong evidence that the company did everything it could do to prevent non-compliance.

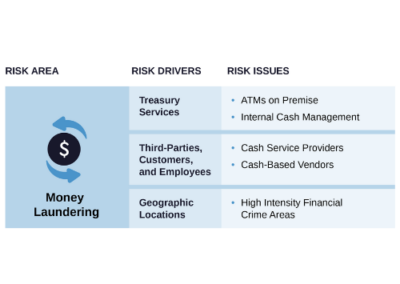

If your commercial cannabis business has an ATM on-site, you need to know about the money laundering risks that you are exposed to. This article describes the ATM risk issue, red flags to be aware of, and controls that you can put in place to mitigate the risk.

Compliance and risk management are two distinct functions that should be unified by one risk management strategy. A risk-based approach is a common risk management strategy in highly-regulated industries that optimally facilitates compliance while also mitigating other risks. A properly implemented risk-based approach creates a broader level of protection for the business, employees, and investors from reputational, administrative, civil, and criminal penalties.

In what appears to be the first penalty levied against a financial institution banking commercial cannabis businesses, Live Life Federal Credit Union has entered into an administrative order with the National Credit Union Administration (NCUA) for failures related to its cannabis banking program. As Live Life Federal Credit Union emerges from this administrative order, and more lessons are learned, cannabis bankers will be more empowered to make the appropriate risk-based decisions when it comes to managing their MRB portfolios.

In highly regulated industries like cannabis, it is important to demonstrate your ability to manage the identified risks as they change over time. Take two investment options that are similar in every way except risk management: an investor would choose the company that can distinctly demonstrate their ability to manage their risks into the future. An investor values risk management because it increases confidence in realizing the future revenue stream.

Risk and compliance professionals know that operating a highly regulated business is difficult. But in the cannabis industry it is exceedingly difficult because of jurisdictional variances and rapidly changing regulations.

Implementing a risk profile does not have to be overly complicated. Risk professionals who know how to communicate their company’s risk profile in a clear, concise manner can best help their senior managers and board of directors make the best risk-based decisions to move their business forward safely.

For commercial cannabis businesses to succeed, risk management should be incorporated into every employee’s job. This helps every cannabis operator reduce public harm, increase public safety, and maintain a sound licensed cannabis market that is profitable to operate in. Risk management isn’t built in a day, but the sooner you start, the sooner everyone gets to do their job.