In highly regulated industries, most companies reduce the risk of civil and criminal exposure by taking a risk-based approach that shows the company’s intent to comply.

Risk Areas

Form 8300 – Do You Have Another IRS Issue?

In the United States of America, commercial cannabis businesses must be aware of the Internal Revenue Service (IRS) requirements for Form 8300 when receiving over $10,000 in cash for a single or related transaction. To reduce your civil and criminal risk exposure, start your risk-based approach to Form 8300 compliance today with a risk assessment, system of control, and looking at the past.

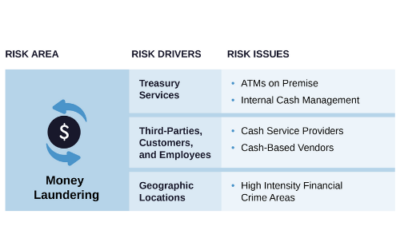

On-Site ATMs: Know Your Money Laundering Risks

If your commercial cannabis business has an ATM on-site, you need to know about the money laundering risks that you are exposed to. This article describes the ATM risk issue, red flags to be aware of, and controls that you can put in place to mitigate the risk.

Make Risk-Based Decisions Part of Your Culture and Stop Firefighting

For commercial cannabis businesses to succeed, risk management should be incorporated into every employee’s job. This helps every cannabis operator reduce public harm, increase public safety, and maintain a sound licensed cannabis market that is profitable to operate in. Risk management isn’t built in a day, but the sooner you start, the sooner everyone gets to do their job.

3 Steps for a Robust Risk Assessment Process

Maintaining compliance in the commercial cannabis industry can be daunting, considering how highly regulated the industry is and how quickly rules change. A compliance risk assessment will help your commercial cannabis business focus resources on the regulatory risks that matter most to your business.

ACCCE Mini-Series: Using Track and Trace Data to Identify Unusual Activity Episode 2

Jontae James, CEO of NatureTrak, will provide a view for both the cannabis business and the ancillary cannabis business on how to accomplish the transparency necessary for both sides to prosper with risk-based due diligence. In this episode, Jontae introduces key information to evaluate, like how much the commercial cannabis business expects to produce/sell, where the cannabis product is going, and who they do business with.

Not all Crime is Organized – Classifying the Illicit Cannabis Market

In North America, it is commonly reported that the illicit cannabis market represents nearly seventy percent of all cannabis transactions. Given this substantial market share, it is necessary to recognize that the illicit cannabis market is more common than the licensed cannabis market.

A Game of Cat and Mouse: Looping for Diversion

As the commercial cannabis industry becomes more entwined in the economy, it is of utmost importance to defend the business against bad actors.

A Problem Worth Solving: Effective Tools for the Challenges of Inversion and Diversion

The transfer of cannabis products into and out of the licensed sector creates great risk for the cannabis business by jeopardizing their active license and risking substantial fines or license revocation by the regulatory authorities.

Sweet Leaf and their Bittersweet Ending

An interview with the former manager of the Data Analysis Unit of the Department of Revenue Marijuana Enforcement division, and the story of how a commercial cannabis company faced criminal charges for trying to circumvent the law.